Whether you’re looking for a credit card, trying to finance a college education or buying your first car, your credit score can have a big impact on your financial future.

In the financial world, lenders use credit scores to measure borrower risk and credit worthiness.

As opposed to a credit report, which provides a detailed record of your loan and account information, a credit score turns your financial history into a three digit number typically between 300 and 850 for easier evaluation. Also unlike a credit report, which can be supplied by any of the three major credit reporting agencies, most credit scores are calculated by one organization called

FICO.

Before funding a mortgage, approving a credit card or determining the APR* for a car loan, lenders often request the potential borrower’s FICO credit score as part of the application.

Understanding Your Credit Score

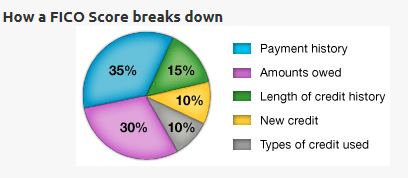

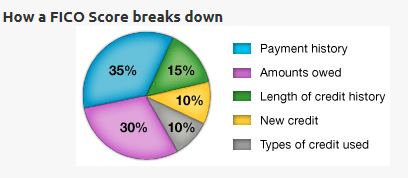

To calculate your credit score, FICO uses different pieces of credit data and information from your credit report. Generally, the five most important factors are payment history, amounts owed, length of credit history, types of credit in use, and new credit requests.

1

While the exact formula FICO uses is a secret and the importance of each category can vary from person to person, here’s a general look at the breakdown of a credit score:

For most borrowers, a higher credit score can lead to lower interest rates on loans and higher credit limits.

Think about your credit score like a grade for your financial life.

When you make positive financial decisions, like keeping your accounts in good standing or paying credit card bills on time, your credit score can improve. When you make risky financial decisions, such as maxing out a credit card or carrying a large account balance from month to month, your credit score can decrease.

Credit Scores in Action

Most people see the impact of their credit score when applying for a loan.

For example, consider two borrowers named Penny and Bill. Both borrowers are in the market for a $15,000, 60-month term, used car loan, but they have different financial habits and, as a result, different credit scores.

Penny, who considers herself more of a saver, has paid off her student loans and never carries a balance on her credit cards. She opened a few credit cards after graduating college, but always pays them off on time. Her FICO credit score is 796.

On the other hand, Bill likes to buy the latest electronics and clothes and he carries a large balance on his credit cards. Generally, he makes his loan payments on time, but he has been late once or twice. His FICO credit score is 654.

When Penny and Bill apply for their loans, they may qualify for a different APR (Annual Percentage Rate) or interest rate. Check out one possible interest rate and loan payment breakdown below:

| $15,000, 60-month term, used car loan |

Penny

Credit Score: 796

Interest Rate: 2.75%

Monthly Payment: ~ $270

Total Interest Paid: ~ $1,100 | Bill

Credit Score: 654

Interest Rate: 8.35%

Monthly Payment: ~ $310

Total Interest Paid: ~ $3,450 |

With her higher credit score, Penny will not only have a lower monthly payment, but she will also pay less on interest over the life of her loan.

This example could be applied to a personal loan, mortgage, student loan or credit card. Nearly all lenders look at FICO credit scores when determining the appropriate loan for an applicant. Having and maintaining a high credit score is the best way to prepare for your financial future and access the best loan rates possible.

Improving Your Credit Score

While a high credit score is ideal, sometimes life events can cause your score to drop. Unemployment, illness and family tragedy can lead to high credit card balances, unpaid bills or bankruptcy.

A low credit score can be frustrating or embarrassing, but it can also be improved.

At Delta Community Credit Union, we offer our members free access to BALANCE™, a financial counseling program. If you’re not sure where to begin improving your finances or want to make sure you’re on the right track, visit the Delta Community BALANCE™ portal and select a program that’s right for you.

Your credit score is the key to your financial future. Choosing positive financial habits, like on time loan payments and low or no credit card balances, can put you on the path to success and help you finance your future home, your next car or your college education.