June 2024

Refer Your Friends and Earn $100

Don't miss out on our limited-time double bonus Refer-A-Friend offer. When you refer friends, family and eligible coworkers to Delta Community, they can enjoy all the benefits of credit union membership that you know and love.1 As a bonus, you'll receive $100 for each qualified referral through June 30. Plus, your referred friends and family can receive a $50 bonus when they join.2

Here's how to take advantage of this limited-time bonus:

- Visit DeltaCommunityCU.com/Refer to get your personal referral link.

- Share your referral link with eligible friends via text, email or social media.

- Get $100 for each friend who opens a Checking Account and meets a few simple requirements.

Be sure to take advantage of our double bonus offer by referring your friends today! Head over to DeltaCommunityCU.com/Refer to share all the great benefits of being a Delta Community member and start earning some extra cash today!

Make Life More Rewarding with the Visa Signature® Card

Get more out of life with the Delta Community Visa Signature® Credit Card! This card offers a way to earn more rewards and extraordinary benefits, including contactless technology, travel discounts and access to unique experiences, all with no annual fee. You'll also earn 1.5x Reward Points per $1 spent, equivalent to 1.5% Cash Back, and a 1.5% Cash Rebate on Balance Transfers made within 90 days of account opening.

As a welcome bonus, you’ll get 15,000 bonus Reward Points, equivalent to $150, when you spend $3,500 within 90 days of account opening.3 To learn more and apply, visit DeltaCommunityCU.com/Signature or stop by a branch to speak to a Delta Community representative.

Live Life Colorfully with a Personal Loan

Need a little extra cash? The Delta Community Personal Loan offers flexible spending perfect for just about anything. We offer great low rates, a variety of repayment options and fixed terms with no annual fee. With a Personal Loan, you can take a dream vacation, finance home improvements, cover household expenses, consolidate high-interest debt,4 fund automobile repairs or whatever you need.

The benefits of a Personal Loan from Delta Community go beyond having extra cash. They include a super-fast approval process and quick access to your funds—all from a lender you can trust. Log in to Online Banking or our Mobile App to apply, or call our Loan Consultants at 844-544-9478 today!

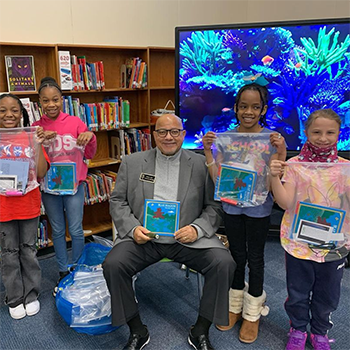

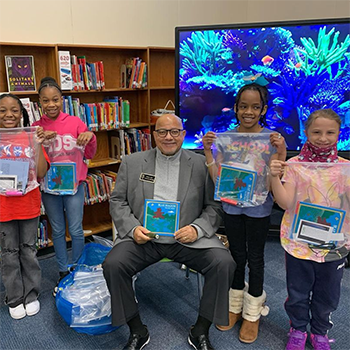

Philanthropic Fund Grants Awarded in May

We recently presented the final grants from our 2024 Philanthropic Fund, totaling $22,500 to the following organizations:

Cobb Collaborative, Inc. (pictured) is a nonprofit focused on improving the wellbeing of children and families. The $5,000 grant awarded will be used to expand its monthly Mayor's Reading Club project, which creates monthly reading kits. Each kit contains a book that corresponds with a theme, a hands-on activity that families can do together, an instructional insert with other ideas to support learning and resources from the Cobb County Public Library. The grant will also help expand and maintain the organization's ‘Little Free Libraries.’

Essential2Life, Inc. is a nonprofit that provides students with leadership and life skills. Essential2Life will use the $7,500 grant to support its Youth Financial Literacy Initiative, which encourages students to set life and financial goals and provides them with the basics of money management to increase their financial literacy.

College AIM is a nonprofit that provides students with expert college and financial aid coaching, helping them explore and access college and career opportunities. The organization also advocates for structural changes that will make the paths to and through college more equitable. College AIM will use its $5,000 award to support its College Access Program, which helps high school students get into technical, associate and bachelor’s degree programs.

The Center Helping Obesity in Children End Successfully (C.H.O.I.C.E.S) is a resource center for families of children in underserved communities that are clinically diagnosed and at-risk of obesity. The nonprofit provides nutrition education via cooking classes to those who can afford to buy food, and mobile food pantries to those who cannot. The organization will use the $5,000 grant award for its “Cooking with C.H.O.I.C.E.S. Family Workshop Series” that teaches children healthy food habits and culinary skills to prepare nutrient dense foods at home, while teaching parents how to make healthy eating fit their budgets.

The Delta Community Philanthropic Fund has invested a total of $150,000 this year to 20 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

Positively Impact a Child’s Life with Zelle® and Bill Pay

Looking for a way to make a difference in a child’s life? Delta Community is working with Children’s Healthcare of Atlanta (CHOA) giving our members an opportunity to help one of Atlanta’s best hospitals. When you make a qualifying Zelle® or Bill Pay transaction now through June 30, $1 will be donated to CHOA, where doctors, nurses and staff are trained to care for children under the age of 21.5

Qualifying transactions include adding and paying a new biller, activating a new eBill, setting up an automatic payment and sending $5 or more to a new person using Zelle®. Experience the convenience of Zelle® and Bill Pay and help Children’s Healthcare of Atlanta today.

Cool Cash Camps

Raise money-smart kids with the help of our Financial Education Center! This month, we’re offering two interactive youth camps to teach children all about money, with in-person and virtual options available. The Elementary School Camp, for grades 2-5, focuses on the basics of money while having fun. We'll discuss how to earn money and identify sources of income, create a savings goal/plan, discuss the difference between wants and needs and explore ways to give to those in need. In the Middle School Camp, for grades 6-8, students will learn to apply financial lessons through a real-life simulation and build on money basics. We will explore how to prepare for earning money and create a real budget. This lesson will cover saving, budgeting, insurance, credit basics and first steps to investing. To register, visit DeltaCommunityCU.com/Events.

Convenient Banking with Live Teller

Have you taken advantage of Live Teller? Live Teller provides interactive banking via video technology, further enhancing the Delta Community service experience. You can speak live, on camera, with a Delta Community employee during and after normal banking hours, skipping our traditional teller line and conducting more types of transactions than a standard ATM. With Live Teller, members can make loan payments, cash checks, transfer funds and more. This service is available at select Delta Community branch locations and will roll out to others in the future. To learn more, visit DeltaCommunityCU.com/LiveTeller.

Out of town or not near a Delta Community branch? We’re part of the Co-Op Shared Branch network, which allows our members to visit other participating credit unions to conduct certain transactions like withdrawals, deposits, loan payments and more. Visit our locations page to find the Shared Branch closest to you.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Our June series will focus on Raising Money-Smart Kids. We're excited to offer two interactive youth camps, designed specifically for Delta Community Credit Union members, to teach children all about money, with in-person locations and virtual options available. We’ll also share financial tips for new parents and ways to teach your kids the necessary financial skills needed to be successful.

- June 4 – 13 : Cool Cash Camps | In-Person Sessions and Live Webinars

- June 4: Becoming a Homeowner| Live Webinar by BALANCE

- June 13: Becoming a Homeowner| Live Webinar by BALANCE

- June 25: Raising Money-Smart Kids | Live Webinar

- June 27: 9 Financial Tips for New Families | Live Webinar

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- How Scammers Could Use Artificial Intelligence to Steal Your Money: Artificial intelligence is still experimental, emerging and not yet fully government regulated, which means that it can be used for illegal purposes, and that crooks may lie and make unrealistic and untrue statements about its capabilities. Since about 2022, scammers have been capable of using AI programs to trick consumers and steal their money. This blog describes actual and possible uses of artificial intelligence by scammers.

- Always Factor in Multifactor Authentication to Help Secure Accounts: Multifactor Authentication (MFA) offers multiple layers of protection for accessing accounts on websites, mobile phones, tablet computers and desktop applications (or apps). One way of explaining the concept of MFA is to compare it to placing your housekeys in a safe deposit box that can only be opened by a biometric facial scan of only your face—a unique authentication method personalized to one person that would be difficult for a hacker to breach or imitate.

- 12 Simple Steps to Water Down Your Water Bill: It is possible to save a little money on utilities without making a big sacrifice in your lifestyle. If you want to try to spend less on water, here are a dozen easy tips to lower water costs without cutting down on the usual home aquatic benefits you are accustomed to.

Financial Status

As of April 30, 2024

- Assets: $8.5B

- Deposits: $7.6B

- Loans: $5.6B

- Members: 507,526

Holiday Closing

Juneteenth, Closed

Wednesday, June 19

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. You can earn up to $500 per calendar year. Referrer must be Primary Accountholder with Delta Community. Bonuses earned through this promotion are subject to IRS reporting. Refer-A-Friend bonus cannot be combined with other promotions and is not valid for previous offers or orders. The person you refer must be at least 13 years old to participate in the program. Bonus payments are made within 60 days of program requirements being met. Referrals made during the special offer period of May 1-June 30, 2024 (“Special Offer Period”) will receive a $100 bonus if the applicant opens a Membership/Savings Account during the Special Offer Period and meets other criteria to earn bonus as described herein. .

2. Applicant must be at least 13 years old, eligible and qualify for membership. To obtain the $50 bonus applicant must (1) Become a member of Delta Community Credit Union by opening a consumer Savings Account with a minimum of $5. Refer-A-Friend Promotion Code must be applied online or in a branch at account opening. Offer not valid if not redeemed by one of these two methods; (2) open any consumer Checking Account within 90 days of opening membership; and (3) deposit $50 to Checking Account and make a minimum of 10 (ten) Visa® Debit Card purchases which post and clear the account within 60 days of Checking Account opening. ATM transactions will not be considered for bonus. To receive bonus, account must be in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements. Bonuses earned through this promotion are subject to IRS reporting. The Annual Percentage Yield (APY) for Savings is 0.25% as of May 1, 2024. The APY for Interest Checking is 0.10% as of April 1, 2024. Rates are subject to change. Free Checking and SpendSafe Checking do not pay dividends. The bonus will be deposited to the Checking Account within 60 days after deposit and transaction requirements are met. Offer is valid for first-time Delta Community members only and cannot be combined with other offers. Offer may only be redeemed once per member. See full program terms at DeltaCommunityCU.com/Refer for additional information.

3. The 15,000 Reward Points will be awarded if you spend a net total of $3,500 in signature-based purchase transactions (without the use of a PIN) minus return transactions within 90 days of account opening. Balance transfers, money transfers, and cash advances do not count toward spend requirement. To qualify, purchases must post within 90 days of account opening. You will not qualify for this offer if you are in default of your Delta Community Visa Consumer Credit Card Agreement. To receive points, account must be in good standing, with deposit balances above zero dollars, any applicable loan payments current, and all accounts in compliance with any other terms, conditions and governing requirements.

4. For debt consolidation, even with a lower interest rate or lower monthly payment, paying debt over a longer period of time may result in the payment of more in interest..

5. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license. This promotion is in no way sponsored, endorsed, administered by or associated with Early Warning Services, LLC or Zelle®.