April 2024

Know the Road You're On

Delta Community is offering members low rates on New and Used Car and Vehicle Loans through May 31. Well-qualified borrowers with excellent credit can get rates as low as 4.99% APR on New and Used Car Loans and as low as 6.79% APR on loans for boats, motorcycles, RVs and more!1 To apply now, log in to Online Banking or our Mobile App and select Apply for a Loan, or call our Loan Consultant Group at 844-544-9478.

Youth and Teen Savings Match

Looking to give your child a head start on their savings journey? Delta Community has you covered! The Youth and Teen Savings “Mix and Match” Promotion is running through April 30. We’ll match the deposits made in the first 14 days, up to $100, when kids and teens ages 0-19 open a new Savings Account. If you have a child, grandchild, sibling, niece, nephew or cousin, they are eligible for a Delta Community Savings Account. Don’t miss out on this fantastic chance to help your child start saving early! To learn more, visit DeltaCommunityCU.com/MixAndMatch.

Financing for Anywhere You Call Home

Members looking to buy their first home, upgrade or refinance can make the experience easy and affordable with a variety of Delta Community Home Loans.* Our experienced team of Home Loan Specialists are ready to guide you toward the very best home solutions and quickly answer any questions from the application process all the way through to closing on your home. Apply through May 31, 2024 and receive $1,000 off closing costs on Fixed and Adjustable-Rate Home Loans2.

For more information, or to apply, visit DeltaCommunityCU.com/ComeHome, call 866-963-7811 Option 1, email Home.Loans@DeltaCommunityCU.com or schedule an appointment with a Home Loan Specialist today.

*We will lend within our lending footprint. Qualification restrictions apply.

HBCU Scholarship Application Period Open

Our first HBCU Scholarship entry period of 2024 is in its final month! Thanks to listeners of V-103 and attendees of their Winterfest concert last December, we are giving away an additional $5,000 scholarship in 2024 for a total of $25,000 in scholarships to five deserving students of Historically Black Colleges and Universities (HBCUs). If you know an exceptional student attending an HBCU or a graduating high school senior who has received an official acceptance letter to one, tell us why they deserve to receive a $5,000 scholarship! You may also nominate yourself. Delta Community will select three winners to each win a $5,000 award from among the most compelling submissions. Visit DeltaCommunityCU.com/HBCU for more information and to apply before April 30!

Plan Your Everything with Delta Community Retirement & Investment Services

Whether you want to kickstart your financial future or refine your current strategy, we have you covered with Delta Community Retirement & Investment Services. Connect with a CERTIFIED FINANCIAL PLANNER™ professional who will take the time to get to know your needs and help you create a plan for wherever you are right now. This team’s main objective is to ensure members are not only investing in their current life journey but also making wise financial decisions through the many important stages of life.3

To learn more visit DeltaCommunityCU.com/PlanYourEverything or to schedule an appointment or request more information, please email DCRIS@DeltaCommunityCU.com or call 404-677-4890.

New Benefit for Delta Community Members

We’re excited to announce Delta Community’s wholly owned subsidiary, Members Insurance Advisors’ collaboration with IHC Specialty Benefits, Inc. (IHCSB), a licensed health insurance agency with access to Affordable Care Act (ACA) compliant health plans and specialty health product lines for individuals and families.4 This collaboration provides access to a broad range of insurance products and services, including:

- Assistance with determining eligibility for premium subsidies

- ACA/Obamacare Major Medical Plans

- Cancer and Critical Illness Plans

- Accident Plans

- Dental/Vision/Hearing Plans

- Short-Term Health Plans

- And more!

If you and your family want a more affordable health plan to meet your current needs, IHCSB can help. Visit our website to learn more and get started today.

Philanthropic Fund Grants Awarded in March

We recently presented four more grants from our 2024 Philanthropic Fund, totaling $32,500 to the following organizations:

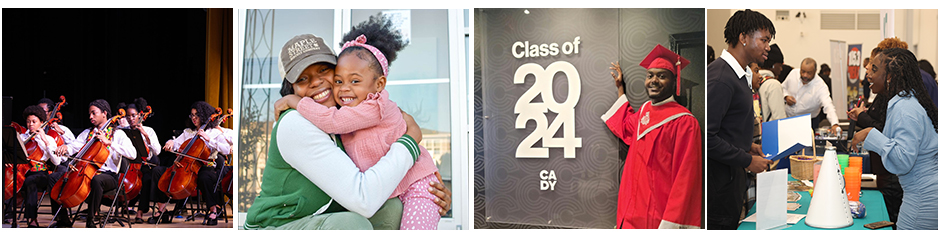

The Atlanta Music Project (pictured, left) operates in under-resourced communities to provide world-class music training and performance opportunities supporting youth growth and development. The $10,000 grant will go towards the organization’s Youth Orchestras and Choirs, which are competitive, tuition-free after-school programs open to middle and high school students. The Atlanta Music Project also provides every student with an instrument, teaching artist and concert opportunities.

City of Refuge (pictured, second from left) offers an environment to help individuals and families transition out of crisis situations. The nonprofit will use its $10,000 grant to support Eden Village, which provides housing with comprehensive services for women and children experiencing homelessness. Eden village can house up to 40 families, offering full-day preschool and education programs to children while their mothers receive case management, financial literacy training, parenting classes and workforce development opportunities to help them prepare for more independent living.

The Future Foundation (pictured, second from right) offers several programs, as well as a network of adults, focused on supporting and changing the lives of South Fulton’s under resourced middle and high school students. The organization will use its $7,500 grant to support its Financial Fix Program, which is focused on teaching financial skills to under resourced families. The program partners with financial literacy professionals including Delta Community.

Future Successors (pictured, right) equips metro Atlanta youth with entrepreneurship and leadership skills. The organization’s $5,000 grant will support Business Minds, its after-school program designed to provide inner-city students with weekly lessons and activities that are business, financial and leadership focused. Business Minds challenges students to create business plans and engage with business leaders in their work environment. Job shadowing and mentorship opportunities are also provided.

The Delta Community Philanthropic Fund will invest a total of $150,000 throughout 2024 to 20 metro Atlanta non-profit organizations that support the physical and financial needs of people who live within the communities we serve.

Delta Community Celebrates 500,000 Members

For more than 80 years, Delta Community has proudly served the metro Atlanta community, and we have successfully grown together over the decades. We recently hit the significant milestone of reaching 500,000 members! To help celebrate and show appreciation to our members, we gave away fun gifts in our branches and hosted contests on our social media platforms throughout the month of March, including the opportunity for one lucky member to win a $1,000 Certificate of Deposit funded by the Credit Union. Be sure to follow us for all the latest Delta Community news, and for chances to participate in contests and win prizes in the future.

We are grateful for each and every Delta Community member—you give real meaning to the Community in our name. Thank you for being a part of our community!

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Register today for April’s webinar series on Buying and Owning a Vehicle. We’ll discuss how to prepare for buying your next car, strategies for improving your credit score, planning for the expenses of car ownership, and the importance of proper insurance coverage. We’ll also host an in-person session with tips on how to finance a vehicle the smart way.

- April 9: Ways to Improve Credit | Live Webinar

- April 11: Car Buying Confidence | Live Webinar

- April 17: Costs of Car Ownership | Live Webinar

- April 23: Auto Financing the Smart Way | In-Person Workshop

- April 25: Am I Covered? Understanding Personal Liability Insurance | Live Webinar

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- Talking Money with Your Family: Power of Attorney: When planning your estate and what will be done with it upon your incapacitation or death, you should expect to be closely involved with many of the steps required to manage it effectively. One of the typical estate planning activities is (often, but not always) collaborating with a lawyer to create several legal documents, such as a power of attorney (POA). A POA can be very helpful in a variety of situations, some of which are discussed in this blog.

- What to Do with Your 2023 Tax Refund, Commission or Bonus: An expected refund, commission or bonus can inspire exciting plans for spending our new money. Splurging on something self-indulgent might seem justified as recent challenges with the U.S. economy have been stressful for many people, both financially and in other ways. It’s natural to want to reward ourselves using part or all of a tax refund or bonus, which we may think of as extra money that’s different from our regular pay. Keep in mind that tax refunds are money that you’ve already earned. Whether it’s your regular pay or a refund, commission or bonus, you should be still be responsible with how you use that money.

Financial Status

As of February 29, 2024

- Assets: $8.5B

- Deposits: $7.6B

- Loans: $5.6B

- Members: 502,647

Holiday Closing

Memorial Day, Closed

Monday, May 27

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™

1. Rates expressed as Annual Percentage Rate (APR). Rates are based on creditworthiness and term of loan. This offer is for new and used cars and vehicles. Income verification may be required. APR available April – May 31, 2024.

2. Receive $1,000 off closing costs when you close a First Mortgage Home Loan. Offer valid for applications submitted April 1, 2024 through May 31, 2024. The offer will be reflected as a lender-paid credit on the closing documents. Offer not valid on Home Equity Loans, Home Equity Lines of Credit or Lot/Land Loans.

3. Securities and Advisory services offered through LPL Financial, a Registered Investment Advisor. Member FINRA/SIPC. Insurance products offered through LPL Financial or its licensed affiliates. The investment products sold through LPL Financial are not insured Delta Community Credit Union deposits and are not NCUA insured. These products are not obligations of Delta Community Credit Union and are not endorsed, recommended or guaranteed by Delta Community Credit Union or any government agency. The value of the investment may fluctuate, the return on the investment is not guaranteed, and loss of principal is possible. Delta Community Credit Union and Delta Community Retirement & Investment Services are not registered broker/dealers and are not affiliated with LPL Financial.

4. These services are available through Delta Community Credit Union’s wholly owned insurance agency, Members Insurance Advisors, LLC (MIA)’s participation in IHC Specialty Benefits, Inc.’s Affinity Program. IHC Specialty Benefits, Inc. (IHCSB), located at 5353 Wayzata Blvd., Ste. 300, St. Louis Park, MN 55416, is a licensed insurance agency. IHCSB CA Lic. #0132310 IHCSB Affinity is a division of IHCSB. MIA is contracted with IHCSB and may receive financial remuneration when you interact with this communication or participate in the services. MIA and IHCSB are not affiliated entities. The services are not provided or endorsed by MIA but are offered as a service for Delta Community Credit Union’s members. THIS IS A SOLICITATION OF INSURANCE BY IHCSB. Contact may be made by an insurance agent or insurance company. Product availability may vary by state.