January 2025

New Year Message from Our CEO

Dear Members,

Happy New Year! I hope the holiday season brought you comfort and a sense of renewal by celebrating life’s many blessings with family and friends.

Delta Community will mark its 85th anniversary in March. Our Credit Union was founded in 1940 on the principle of cooperation. Eight employees of Delta Air Lines donated from their personal savings to create a fund that their co-workers could borrow against, when needed, on an equitable basis and at a fair rate. Since day one, all earnings from the financial products and services offered were re-invested in the Credit Union to foster its viability and serve the interests of the membership as a whole.

Delta Community’s mission remains constant, and we now have 1,350 professionals who take pride in helping our members manage their household finances more effectively. Their belief in our service-oriented structure is evidenced by our inclusion on the Atlanta Business Chronicle’s list of Best Places to Work for 10 consecutive years.

Here are highlights of our recent and pending efforts to better serve you:

- Financial Strength – Our net worth ratio was nearly 12% at the end of 2024 and above the average for credit unions nationally. These capital reserves enable us to deliver more consistent value and support across varying economic cycles.

- Member Growth – Our annual net member growth exceeded 2.5% and was almost three times higher than our peers. Ongoing member growth is a win-win proposition that drives cost efficiencies and allows us to extend value to more consumers locally, so please recommend Delta Community to others whenever possible.

- Deposit Growth – We had almost $300 million in annual deposit growth as members recognized the ongoing competitiveness of our dividend rates and low-fee pricing. Delta Community always strives to offer highly attractive, dependable yields and never engages in teaser rates or unsustainable pricing as a marketing ploy.

- Loan Growth – Our annual direct loan growth exceeded 9% and was well ahead of industry forecasts for the year. These originations consisted of $400 million in auto loans and $730 million in home loans to Delta Community members.

- Expanded Services – We introduced two new checking accounts, Interest Checking and SpendSafe Checking® (a no-overdraft option); added contactless technology to our Visa debit and Platinum cards; upgraded 12 more ATMs with Live Teller or video chat functionality; and announced plans to open two new metro Atlanta branches in 2025, Locust Grove and Conyers.

- Member Satisfaction – Our full-year, weighted Net Promoter Score was the best in our history, eclipsing our prior high from 2019. We also earned the highest Net Promoter Score among credit unions nationally for the sixth consecutive year in an annual industry benchmarking study conducted by Raddon, a Fiserv Company.

We shared news in September about the passing of our longtime Chairman, Jim Diffley. Jim served our Credit Union for 62 years, first as a member of our Credit Committee and later as a member of our Board of Directors. We will soon rename the Boardroom at our corporate office in Jim’s honor, and his commitment to cooperative finance and community involvement lives on through the dedication and integrity of his fellow Directors who continue to govern Delta Community’s operations.

Thank you for being part of Delta Community. We appreciate the opportunity to serve you and will always strive to maintain your confidence.

Best wishes for much health and success in 2025!

Sincerely,

Hank Halter

Chief Executive Officer

New Branch to Open in Conyers

We are excited to announce that our 31st branch location in metro Atlanta is coming to Conyers! This full-service branch will open in the summer of 2025 and will feature two 24-hour ATMs that will also function as Live Tellers. The branch will be located at 1448 Old Salem Road in the Salem Gate Market Shopping Center. “Our new branch will allow us to better serve our members in Rockdale County, and welcome new members from nearby communities to enjoy the personalized care and benefits of our credit union,” said Delta Community CEO, Hank Halter. Follow us on Facebook for updates regarding the progress and opening of this branch.

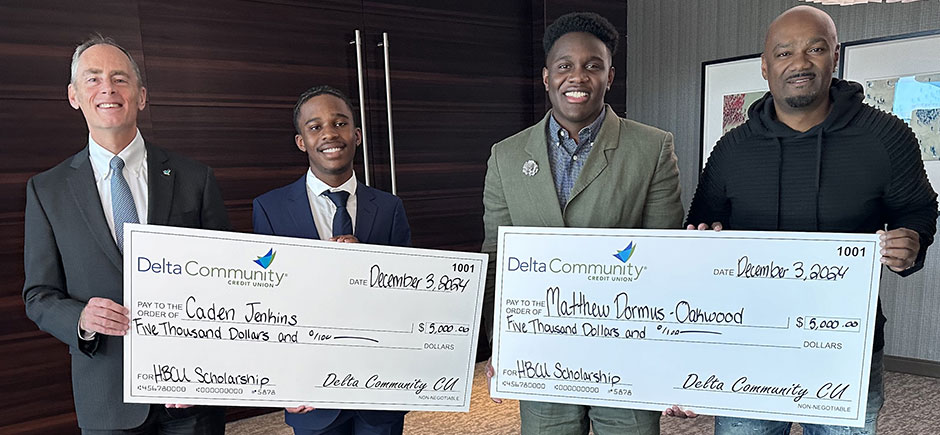

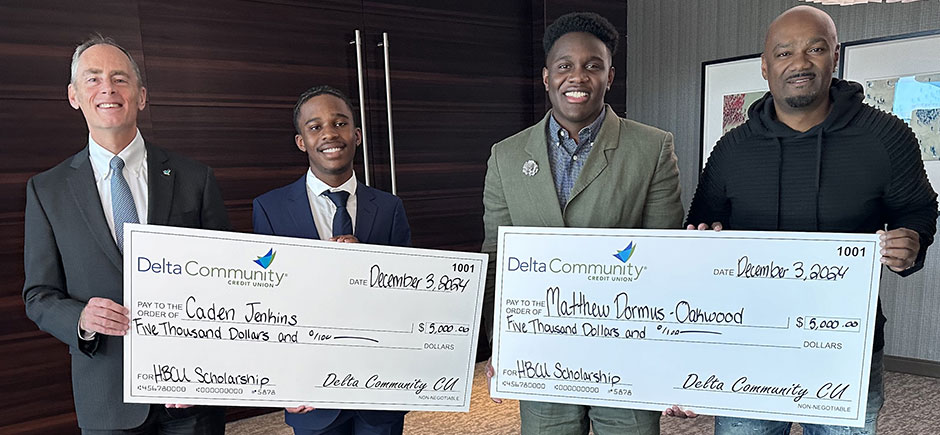

$10,000 Awarded to Two HBCU Students

In December, Delta Community and Atlanta radio station V-103 presented our final HBCU Scholarships of 2024, awarding $5,000 each to Matthew Dormus and Caden Jenkins.

Matthew Dormus, a junior at Oakwood University studying public policy, was named a 2024 White House HBCU Scholar. He collaborates with NASA and senior U.S. officials and is the creator of several video series, including Meet the Scholars, Good Morning OU and Crown Talk, which highlights HBCU campus leaders. He also spearheaded a mental health initiative, The Story Room, a campus space featuring stories of students overcoming challenges. Matthew has been recognized as a Carson Scholar seven times and was inducted into the Carson Scholars Fund Hall of Fame. Originally from Hampton, Georgia, he graduated from Georgia Cumberland Academy in 2022.

Caden Jenkins, a high school senior at The New School Atlanta, maintains a 3.98 GPA and plans to study architecture at one of several HBCUs he has been accepted to. He has led extensive community service efforts, including founding A Giving Hand in 2021 to collect and donate food and clothing to those in need. He also volunteers with organizations like the Atlanta Community Food Bank and Eastside Church’s Community Closet, while supporting charities like Free99Fridge and Covenant House Georgia. Through his work, Caden has dedicated over 50 hours to combating food insecurity in Atlanta.

Visit our website to learn more about each of these scholars. Throughout 2024, Delta Community awarded a total of $25,000 in scholarships to students attending Historically Black Colleges and Universities. The HBCU Scholarship is part of our annual Scholarship Program which awards an additional $25,000 in scholarships to students pursuing advanced degrees.

2025 Philanthropic Recipients Named

We are excited to announce that we have selected our 2025 Philanthropic Fund recipients. Throughout the year, Delta Community will invest $150,000 in support of 20 nonprofit organizations that provide education and health and human services to its participants. An employee committee, pictured above, selected the grant recipients from nearly 250 applications received last year. Among the 20 organizations to receive a grant are Operation Hope, Aurora Day Camp and Atlanta Children’s Day Shelter.

With the awarding of these 2025 grants, the Philanthropic Fund will have invested more than $1.3 million in approximately 240 nonprofit organizations in metro Atlanta since its launch in 2014. Visit our Philanthropic Fund page for the full list of recipients and more information on how your organization can apply for a grant.

Elevate Your Career at Delta Community

Delta Community Credit Union provides more than just membership benefits—it offers rewarding career opportunities. Financial advisors seeking meaningful opportunities—or members looking to connect a friend or family member to a team that shares their values—can find an ideal fit at Delta Community Retirement & Investment Services.

As part of this team, you’ll work with CERTIFIED FINANCIAL PLANNER™ professionals who are committed to integrity, financial education and helping members achieve their financial goals. With access to centralized resources and the support of a dedicated client services team, you can focus on guiding clients through life’s milestones. Warm referrals from loyal members and branch personnel help you build lasting relationships—no cold calling required.

Delta Community Retirement & Investment Services is committed to the growth and success of its team members offering mentorship, clear career paths and financial support for obtaining professional certifications. And, as part of a trusted credit union serving more than half a million members, your work will empower generations and create lasting value.

Recognized as one of Atlanta’s Best Places to Work for 10 consecutive years, Delta Community Credit Union fosters a collaborative, purpose-driven environment. Openings at Delta Community Retirement & Investment Services include Financial Consultant, Associate Wealth Advisor and Wealth Advisor positions. Delta Community also has opportunities in its Member Care Center in Vinings and branches across metro Atlanta.

Applying is quick and easy—you can start directly from your mobile phone or tablet. Visit our website to learn more and take the first step toward a fulfilling career at Delta Community.

Activate Your Bonus Rewards

Each quarter, we offer an opportunity for members who have our Visa® Platinum Rewards Credit Card to earn Bonus Reward Points for purchases in select categories from restaurants to retail.

If you’re a Platinum Rewards Credit Card holder, be sure to enroll each quarter to earn 2x or 3x the Reward Points on the purchases you make every day. Activate bonus categories for January through March to earn 3x Reward Points for eligible purchases at Restaurants and Fast Food, Wholesale Clubs, Discount and Department Stores, 2x Reward Points for eligible purchases at Gas Stations and Grocery Stores, and 1x Reward Points for every $1 spent on eligible purchases in categories outside the bonus categories.

To activate, log in to your account and select Reward Points under the Additional Services tab or More in our Mobile App. Click the link to enroll for the current quarter or an upcoming quarter. When you’re ready to redeem your points, you can choose from a wide variety of Cash Back, Gift Cards, Merchandise and Travel with no blackout dates.

Financial Education Center Seminars

At Delta Community, we know that knowledge is the key to reaching your financial goals and establishing good financial habits. That’s why we’re offering a series of workshops each month focusing on a different aspect of personal finance. Whether you’re planning for a major milestone or trying to better manage your finances, our Financial Education Center offers the tools to help you achieve financial success.

Start 2025 on the right financial foot with our Mastering Your Money workshop series in January. We’ll equip you with practical strategies to recover from holiday expenses, create a personalized budget and better understand the influences behind your spending habits. You’ll also discover effective ways to reduce expenses, build savings and participate in an interactive session to help you design a financial roadmap for the year.

Check our Events & Seminars page for more information on upcoming seminars.

Monthly Blogs

- When Mailing a Paper Check Might Be a Better Choice Than a Person-to-Person Payment: Millions of Americans use person-to-person (P2P) electronic payment services such as Venmo every day, often on their mobile phones. These digital payment services are popular, fast and easy, but sometimes, in certain situations, you may not want to use them. If these payments are so convenient and efficient, then why not use them all the time?

Financial Status

As of November 30, 2024

- Assets: $8.9B

- Deposits: $7.8B

- Loans: $5.7B

- Members: 512,153

Holiday Closing

Monday, January 20

Martin Luther King Jr. Day, Closed

Contact Us

Member Care: 800-544-3328

Home Loans: 866-963-7811

Locations

EVERYTHING YOUR BANK SHOULD BE™