Merging Finances

Combining finances with your significant other can be a convenient way to split financial obligations, share financial goals and hold each other accountable. Communication is key, and it’s important to have an open and frank ongoing conversation about where you both are and what you want to achieve in your lives.

Checklist – Merging Finances

- Discuss one or two shared goals. You might both want to pay down debt, establish an emergency fund, start earmarking some income for a new home, etc. Once you’ve established a few shared goals, then you can start to make significant strides in your financial future as a couple.

- Gather resources, including credit reports, details of assets (from bank statements, investment and retirement accounts), list of debts and copies of your paychecks and employee benefits.

- Utilize Delta Community’s Online Banking personal money management tool to link accounts for a full view of your financial portfolio.

- Consider scheduling a recurring “money date” to sit down and review resources and discuss your goals. Download a worksheet to guide that first conversation.

- Discuss the money values of the people who raised you. Were they savers or spenders? Talk about what matters to you that money can help you achieve.

- Discuss family aspirations. Do you have plans to add to your family? If so, will both parents work full-time, or will one work part-time or stay at home?

- Discuss career goals and education. Do either of you plan to go back to school?

- Put your goals in writing. Be specific. For example:

- Establish an emergency fund with six months of living expenses.

- Defer 10% of your pay into each retirement savings plan (such as a company-sponsored 401(k)).

- Discuss how you will handle financial responsibilities as a couple, either jointly or separately. These responsibilities include managing bills, making investment decisions, preparing taxes, shopping for service providers and reviewing and selecting employee benefits.

- Decide if each partner will have a checking account or if you’ll share a joint checking account. Also, consider how much access you want your partner to have to any separate accounts or assets. Research if additional authorization is needed with any of your service providers to make account changes or get information (i.e., utilities, lease or mortgage, credit cards, cellular or internet service, etc.).

- Determine if expenses will be split 50/50 or allocated according to income.

- Update beneficiary designations and estate planning documents (Will, Financial Power of Attorney and Advance Medical Directive).

- Evaluate your life insurance needs. As you begin to share financial and household responsibilities, many couples become dependent on each other’s income, and life insurance can provide financial support if something unexpected occurs.

How We Can Help

Delta Community can help you decide how you and your partner can best combine your financial lives as you look forward to your years together. Consider meeting with one of our CERTIFIED FINANCIAL PLANNER™ professionals to review and discuss your joint goals and if a detailed plan could help better unify your finances for a stronger future.

Certified Financial Planner Board of Standards Center for Financial Planning, Inc. owns and licenses the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States to Certified Financial Planner Board of Standards, Inc., which authorizes individuals who successfully complete the organization’s initial and ongoing certification requirements to use the certification marks.

Your Credit Union (“Financial Institution”) provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. The Financial Institution is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Delta Community Credit Union and Delta Community Retirement & Investment Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using Delta Community Retirement & Investment Services, and may also be employees of Delta Community Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Delta Community Credit Union or Delta Community Retirement & Investment Services. The Delta Community Retirement & Investment Services site is designed for U.S. residents only. The services offered within this site are offered exclusively through our U.S. registered representatives. LPL Financial Registered Representatives associated with this site are licensed in all 50 states.

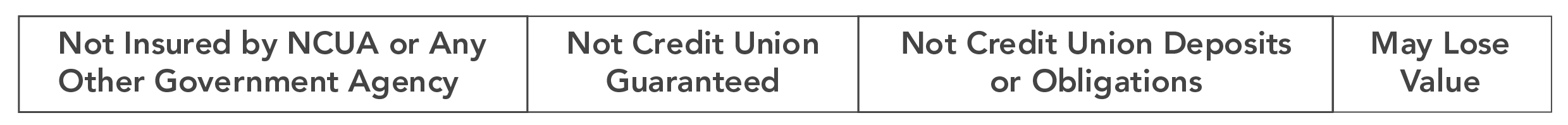

Securities and insurance offered through LPL or its affiliates are: